income tax malaysia 2019 calculator

Income Tax Slab Rates for FY 2019-20 AY 2020-21. 15 of the Advance Tax.

Pcb Calculator 2022 Epf Calculator Socso Table Free Malaysian Payroll Software

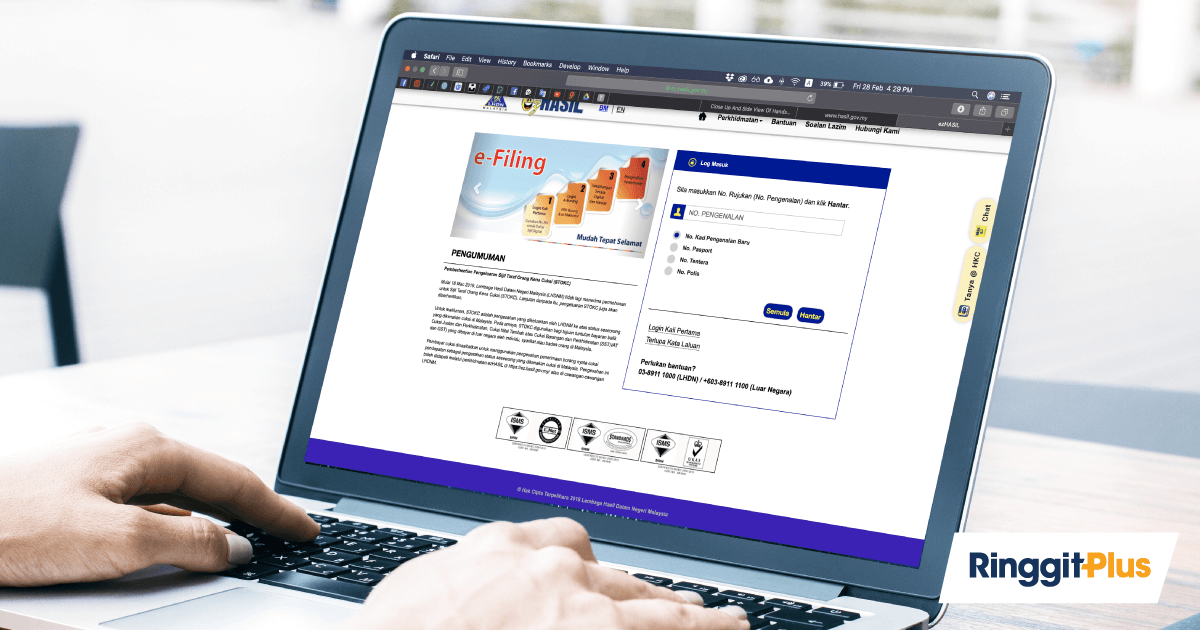

Bagi meningkatkan ketelusan dan penglibatan awam dalam pentadbiran cukai langsung Lembaga Hasil Dalam Negeri Malaysia HASiL mengalu-alukan orang ramai untuk menyertai Konsultasi Awam.

. Valid for an original 2019 personal income tax return for our Tax Pro Go service only. Online is defined as an individual income tax DIY return non-preparer signed that was prepared online either. Americas 1 tax preparation provider.

The Monthly Wage Calculator is updated with the latest income tax rates in Malaysia for 2022 and is a great calculator for working out your income tax and salary after tax based on a Monthly income. A mortgage loan or simply mortgage ˈ m ɔːr ɡ ɪ dʒ in civil law jurisdicions known also as a hypothec loan is a loan used either by purchasers of real property to raise funds to buy real estate or by existing property owners to raise funds for any purpose while putting a lien on the property being mortgaged. 12500 under Section 87A of IT Act.

Self-Employed defined as a return with a Schedule CC-EZ tax form. An entity which provides insurance is known as an insurer insurance company. No cash value and void if transferred or where prohibited.

According to Section 45 of Malaysias Income Tax Act 1967 all married couples in Malaysia have the right to choose whether to file individual or joint taxes. Engine as all of the big players - But without the insane monthly fees and word limits. 1 online tax filing solution for self-employed.

Beginning with the 2019 tax year the IRS allows you to e-file amended tax returns if you filed the original return electronically and provided that your tax software supplier supports electronically filing amended returns. This means that low-income earners are imposed with a lower tax rate compared to those with a higher income. ORANG RAMAI DIALU-ALUKAN UNTUK MENYERTAI KONSULTASI AWAM DENGAN HASiL.

It is a form of risk management primarily used to hedge against the risk of a contingent or uncertain loss. Based upon IRS Sole Proprietor data as of 2020 tax year 2019. International tax law distinguishes between an estate tax and an inheritance tax citation needed an estate tax is assessed on the assets of the deceased while an inheritance tax is.

Amount Payable as Advance Tax. Lee the court ruled that there could be a corporate tax essentially saying the structure of business was a justifiably discriminatory criterion for governments to consider when writing tax legislation. Offer valid for returns filed 512020 - 5312020.

Income tax deductions on tuition fees expenses of school and college going children in India can be claimed by individual employed in India under section 10 14 of the income tax act. Valid for an original 2019 personal income tax return for our Tax Pro Go service only. This maximum investment amount is decided by the government.

The income tax slab is a slab under which an individual fall is determined based on the income earned by an individual. Section 10 14 provides tax benefit up to Rs 1200 per year per child up to two children for expenses on education including. This was a unique ruling handed down during a unique time in US history that denied a corporation freedom it sought in the courtroom.

Theres still time for you to carefully. Advance Tax Due Date. Must provide a copy of a current police firefighter EMT or healthcare worker ID to qualify.

Due Dates for the Payment of Advance Tax in the FY 2019 2020 AY 2020-2021. Income Tax Rates and Thresholds Annual Tax Rate Taxable Income Threshold. I am single Unmarried will be sending some part of income back to india to my parents.

Income Tax Slab for Financial Year 2019-20. PLB amount equivalent to 78 days of wages were paid for the year 2010-11 and 2019-20. The resident taxpayers are divided into three categories based on an individuals age.

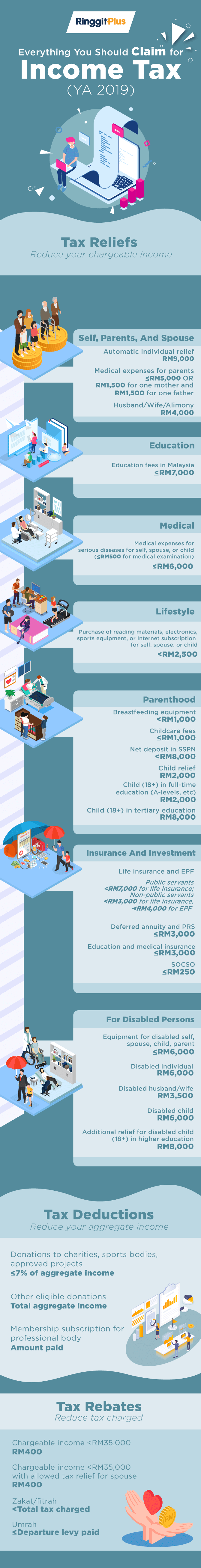

Which Sections Address Income Tax Deduction Benefit for Tuition Fees. The different Sections of the Income Tax Act help the salaried individuals and the self-employed people and professionals to make their rent expenditures cheaper and more desirable. There are also differences between tax exemptions tax reliefs tax rebates and tax deductibles so make.

The most common sections in Income Tax Act are 80C 80CCD 1B 24 b and 80D. HRA or House Rent allowance also provides for tax exemptions. No cash value and void if transferred or where prohibited.

I want to know is it reasonable amount to survive there. 1961 is available to the individuals who have a yearly income up to Rs. With our income tax calculator you can roughly estimate how much tax savings you will be able to make when you file for your tax in 2019.

Income tax calculation can be done either manually or by using an online income tax calculator. Tool requires no monthly subscription. Our online advance income tax calculator is mobile friendly and can be used in both computers and mobile devices in a hassle free fashion.

For salaried employees. Malaysia Personal Income Tax Calculator for YA 2020 Malaysia adopts a progressive income tax rate system. However every section amongst these has a pre-set maximum investment amount.

The calculator is designed to be used online with mobile desktop and tablet devices. The bonus will be paid for the year 2020-21 as. Soon Ill be joining a Company at Kuala Lumpur and Ill be getting RM 6000 as monthly income.

Departure tax and tourism tax in Malaysia are a beautiful combination to rip off tourist to the. Malaysia Residents Income Tax Tables in 2022. Salaries of the employees of both private and public sector organizations are composed of a number of.

Must provide a copy of a current police firefighter EMT or healthcare worker ID to qualify. Content Writer 247 Our private AI. Based on the income tax slab an individual falls into they do their maximum tax saving.

The system is thus based on the taxpayers ability to pay. Individuals whose income is less than Rs25 lakh per annum are exempted from tax. The loan is secured on the borrowers property through a process.

By doing so you may receive a refund for some or. Offer valid for returns filed 512020 - 5312020. An inheritance tax is a tax paid by a person who inherits money or property of a person who has died whereas an estate tax is a levy on the estate money and property of a person who has died.

Over 500000 Words Free. As the leader in tax preparation more federal returns are prepared with TurboTax than any other tax preparation provider. Review the full instructions for using the Malaysia Salary After Tax Calculators which details.

Insurance is a means of protection from financial loss in which in exchange for a fee a party agrees to guarantee another party compensation in the event of a certain loss damage or injury. Under the Section 11A on the Income Tax Act equity and equity shares funds that have been sold in stock exchange and securities transaction tax on such short-term capital gains is chargeable to tax at a rate of 10 percent up to 2008-9 and 15 percent from 2009-10 onwards. However under sections 216 2161 217 and 2183 of the Income Tax Act you have the option of filing a Canadian tax return and paying tax on certain types of Canadian-source income using an alternative tax method.

The amount of tax that must be paid will depend on the tax slab under which you fall. Household Income and Basic Survey Amenities Report 2019 DOSM. If you guys want to know which classification you actually belong to and the accurate number do the maths and see the median take the middle number.

According to the budget released in 2019 there have been some changes in the structure of the tax slab in the interim budget 2019 the tax rebate of Rs. On or prior to 15th of June.

Taxable Income Formula Examples How To Calculate Taxable Income

How To Do Pcb Calculator Through Payroll System Malaysia

Income Tax Formula Excel University

Tax Depreciation Myths Debunked Tax Alert June 2019 Deloitte New Zealand

2022 Malaysian Income Tax Calculator From Imoney

What Do Taxes Pay For Defense Social Security Medicare And More

Malaysia Personal Income Tax Guide 2020 Ya 2019

Joint Ownership Of Property How Rental Income Is Taxed

Personal Income Tax Malaysia Guide For Ya2020 Excel Template Included Life Of A Working Adult

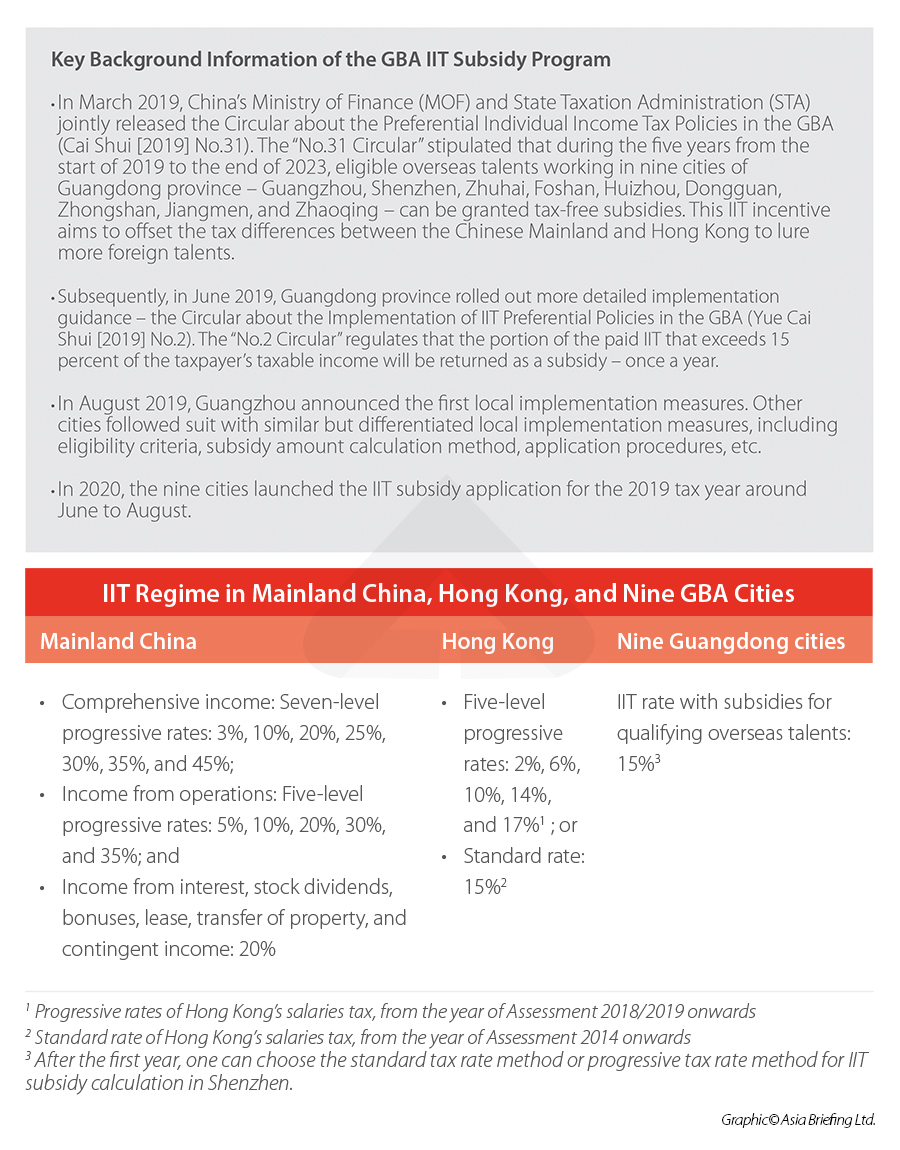

Iit Subsidies In China S Greater Bay Area File Your 2021 Application Now

Malaysia Salary Calculator 2022 23

Malaysia Personal Income Tax Guide 2020 Ya 2019

Rental Income Tax Malaysia And Other Tax Reliefs For Ya 2021

Rental Income Tax Malaysia And Other Tax Reliefs For Ya 2021

What Is The Corporate Tax Rate Federal State Corporation Tax Rates

408 Malaysia Tax Service Currency Stock Photos Pictures Royalty Free Images Istock

0 Response to "income tax malaysia 2019 calculator"

Post a Comment